April-May 2014

Hope for Bulgaria

------------------

|

brown on green, A Regular column about finances

Weathering the Storm

Much debate has taken place throughout the years over how to invest when the stock market is extremely volatile. The stock market works the same as any market. The law of supply and

demand drives the price. Selling stocks in low demand drives down the price while stocks in high demand force the price up, enticing stockholders to sell. Collapses happen when the market has too many sellers and not enough buyers. It rallies when the market has too many buyers and not enough sellers

We all like to think we are rational people who do not make emotional decisions, but the majority of us make decisions based on emotions. These emotional choices are also true of those making decisions about buying or selling stocks. When a panic starts in the stock market, the majority wants out all-at-once, and prices are driven lower. The reverse is true as well. When the majority thinks every stock is a good buy, the market is driven higher. In both cases, from a logical standpoint, the market goes lower or higher than it should.

During the meltdown in March of 2009, we saw the stock values of many companies dip below their cash-on-hand. In other words, their stock prices were so low, the company could have used its own cash to buy the stock and become privately held.

Some believe you should “time the market” by selling when the market peaks, staying on the sideline until the market hits rock bottom, and then jumping back into the market at its lowest point. Simply put: sell high and buy low.

The problem with this method is that no one can accurately predict the future of the market. Many who attempt the sell high/buy low strategy sell too early. They miss the peak of the market and find themselves on the sidelines as the market rises another 10%. They often miss on the other end as well, and do not get in on the lowest prices, therefore missing the first 10% of a rally.

A diversified portfolio of stocks held through the fluctuations of the market has proven to be the best strategy to follow. Many long-term studies indicate that “market timers” do not do better than those who buy and hold.

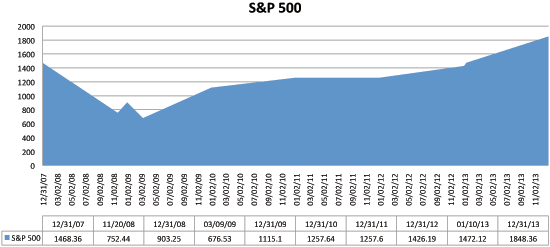

We have experienced much market volatility since the end of 2007, with the S & P 500 falling to a low of 676.53 on March 9, 2009. As this article is being written, however, the S & P is at 1,831.40 for a long-term gain of over 170%.

Refer to the information graphic above for highlights of the recent “Great Recession” period. The stock market storms can rage at times, but if you just hang on and weather the storm, you will come out better than by trying to time the market.

David Brown, CPA, became director of the Free Will Baptist Foundation in 2007. Send your questions to David at david@nafwb.org. To learn how the Foundation can help you become a more effective giver, call 877-336-7575.

|

|