April-May 2019

Priority One:

The Gospel

------------------

|

brown on green, A Regular column about finances

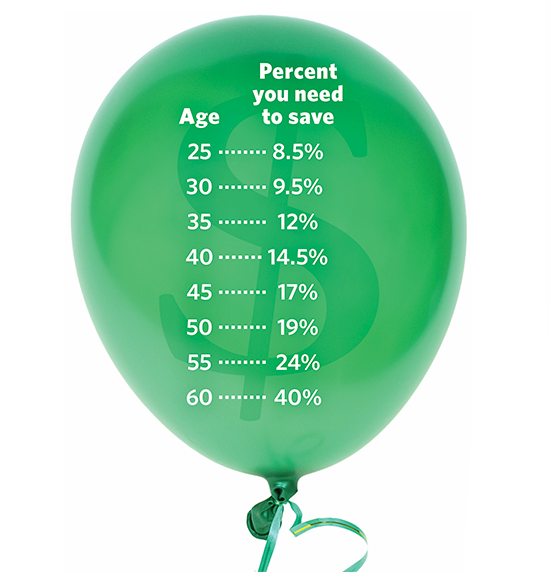

Squeezing the Balloon

Have you ever played with one of those long, skinny balloons—the ones clowns use to create balloon animals? When you squeeze one end of the balloon, the air has to go somewhere, so it goes to the other end of the balloon. If you squeeze in the middle it goes to both ends. The principals of investing are similar.

Let’s say you determine you need $500,000 in your retirement account to retire comfortably. Three variables must be considered to reach your retirement goal: the amount you can afford to save; the measure of risk you can tolerate; and the amount of time to reach the goal.

If you are squeezed on the amount of time because you delayed saving for retirement, it means the amount you need to put back each month must be higher, along with a higher rate of return.

If you are a conservative investor and don’t feel comfortable in the stock market, you squeeze the rate of return. If your rate of return is lower, it necessarily means the amount you save per month must increase, and the amount of time you need to save will increase.

If you can’t save very much per month and have to squeeze the amount you can save, the rate of return must increase, and you will need more time. These three areas are tied together, so you first need to determine what takes priority in order to reach your goal.

The chart above illustrates this concept. In this case, the income replacement rate is 65% of your income. This is a very minimal retirement as many financial advisors suggest a replacement rate of 70-80%. In this example, the dollar amount will vary depending on how long it is until you retire. This example also assumes starting at zero at each age. The assumed retirement age is 67, full retirement age for anyone born after 1960. The example also assumes Social Security will be a portion of your retirement income. The assumed rate of return is 7%.

Many companies offer to match your 401k or 403b contributions to a certain level. A common matching contribution is to match the employee’s contribution up to 5%. In other words, if the employee contributes 5%, the account will receive 10%. This is like a 100% return and will greatly reduce the amount you may need to reach your retirement goal.

Obviously the younger you start saving, the smaller the percentage of your income you need to save, so start squeezing the balloon as soon as you can!

About the Columnist: David Brown, CPA, is director of Free Will Baptist Foundation. To learn more about the grants program, visit www.fwbgifts.org.

|

|