February-

March 2017

Mission: Stewardship

------------------

|

Risk Decreases Over Time

By John Brummitt

I have always been interested in how the stock market works.

I got my first real experience in a college business finance course where we were “given” $25,000 in imaginary funds and told to invest in no less than five different stocks. At the end of the semester, we analyzed our portfolios to see who had made the best picks. Fun exercise. At the end of the semester my portfolio value was close to $50,000! The interesting thing to me was that four of my five stocks had less value than my initial investment. One company had driven all of the performance. Of course, all of the stock picking on my part was blind luck in that exercise. This taught me that to reduce the risk of loss in your portfolio you need time and diversification.

In the years since that first experience, I have furthered my education and practice in the stock market. While I now have a team picking which stocks will be winners, I still understand that a diversified portfolio has a much better chance for positive returns with the wider range of investments I hold. And the longer I hold those investments, the lower my risk of loss become.

When it comes to investing in the stock market, too often people jump in after all the major growth has already happened. Much like hearing about a great sale three days late and getting to the store on the last day after everything has been picked over. You take what is left, but the limited selection and offerings must be examined closely if you are going to purchase. Picking from stocks that have already had big gains doesn’t mean they will have big gains going forward, and many times they head in the opposite direction.

The idea of buying an Apple, Inc. or an Alphabet, Inc. (Google) and riding the gains all the way to the top is a rare thing. Also, it is very hard to do on a consistent basis. Having a diversified portfolio from different sectors of the market gives you less risk of loss based on one or two companies. The closer your portfolio is aligned with the market, the more your returns will match or beat what the market is doing.

For most people, the idea of the stock market is foreign. It doesn’t work the way we naturally think about things. When markets are going down is the time you should buy, but the natural reaction is to sell and protect assets from losses. When markets are running up and have had good returns, we should be looking for exits to capitalize on gains. It just doesn’t seem natural. We want to wait and see things going well before getting in and want to jump out at the first sign of a downward turn. Turning to bonds even though we have several years until retirement, or planning to withdraw our investments entirely can also hurt our growth.

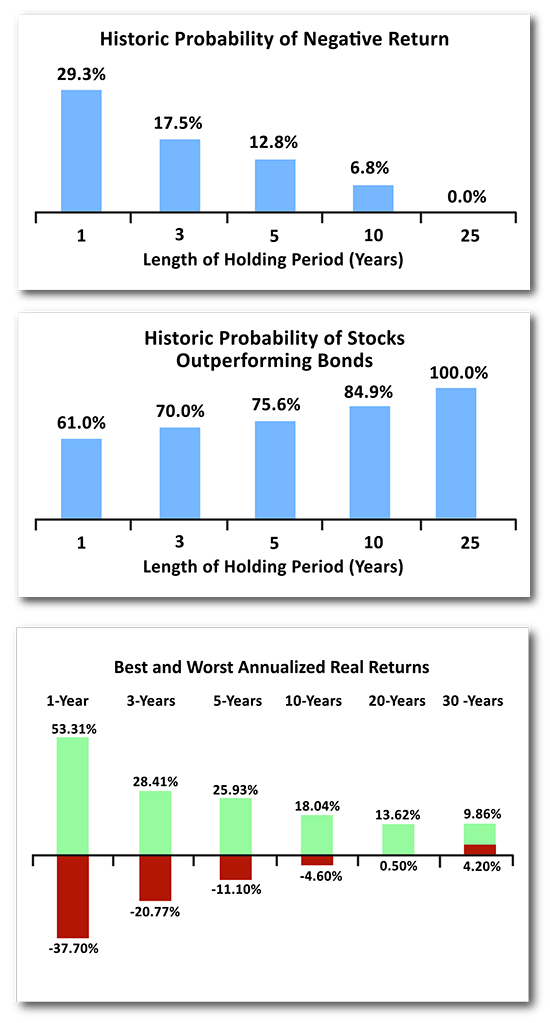

Even in a one-year time period, investors have a 61% chance of stocks outperforming bond returns. The longer your timeline, the closer that chance moves to 100%. Historic returns of the stock market show that the longer you hold your investment, the less chance you have for a negative return. Even if you were to pull out the worst 15-year span from the market from 1926 to 2009, you would still have positive earnings.

As you look at the volatility of the stock market in its day-to-day action, try to remember you invest for a long timeline. With a diversified portfolio, the risk of loss falls as your time period grows.

About the Writer: John Brummitt became director of the Board of Retirement in January 2016. He graduated in 2011 with an MBA from Tennessee Tech University. A 2004 graduate of Welch College, he has been with the Board of Retirement since the spring of 2006. Learn more about retirement options: www.BoardofRetirement.com.

|

|